by kimballcreekpartners | Nov 7, 2023 | Kimball Creek Blog

The penultimate month of the year is often a time to reflect and offer thanks. And while economic and geopolitical uncertainty can overshadow the positives, there are things to be thankful for. Here is just some of what we’re thankful for, now that we’re in the second...

by kimballcreekpartners | Dec 1, 2022 | Kimball Creek Blog

When you leave your job, you have several options when it comes to your 401k account. One option is to leave your 401(k) with your former employer. If you have a balance of at least $5,000, you can usually keep your money in the plan and continue to manage it as you...

by kimballcreekpartners | Nov 17, 2022 | Kimball Creek Blog

I have checked the “unemployed” box a couple times in my life. It stinks. It can also be scary, stressful, and lonely. But there is no shame in it (and don’t let your shoulder devil convince you otherwise!) There is also no shame in scrimping to save a couple bucks or...

by kimballcreekpartners | Jun 14, 2022 | Kimball Creek Blog

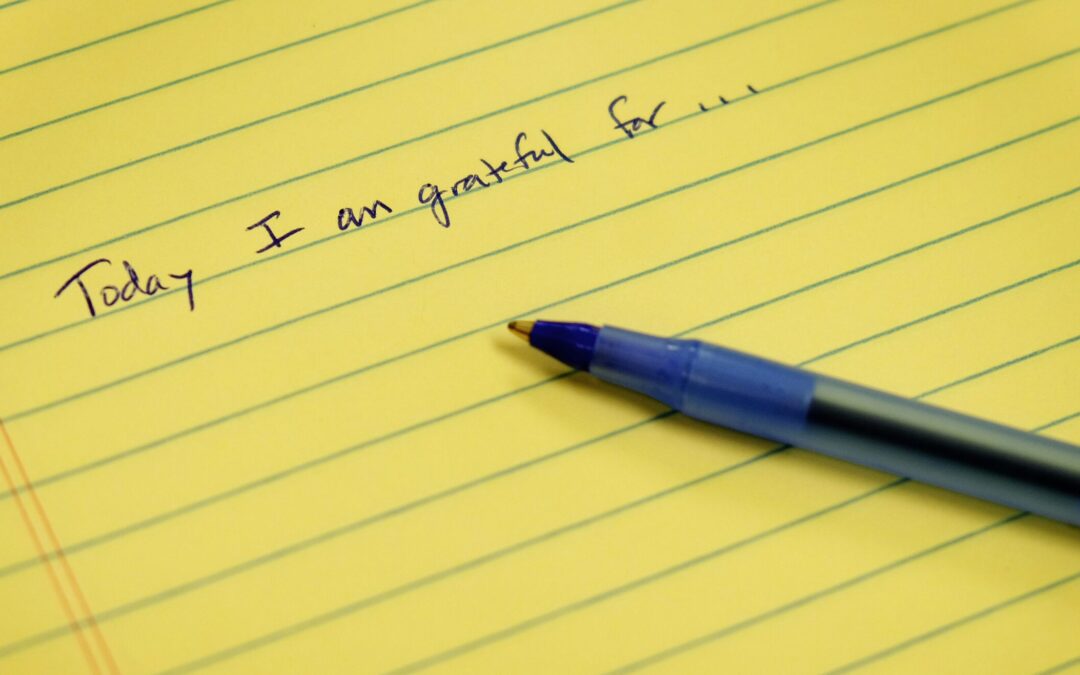

The stock market is crushed! Do you feel a pit in your stomach when you look at your portfolio balance? It’s time to THINK SLOW. Daniel Kahneman (winner of the Nobel Prize in economics) has written that there are 2 types of thinking: System 1 is Fast. It is driven by...

by kimballcreekpartners | Jun 7, 2022 | Kimball Creek Blog

You’ve kept us extra busy these days, working with people you’ve sent who are going through transitions right now. It’s been a reminder that we don’t always pick the time when retirement savings are needed to fund the next chapter, when a death turns someone who is...

by kimballcreekpartners | May 9, 2022 | Kimball Creek Blog

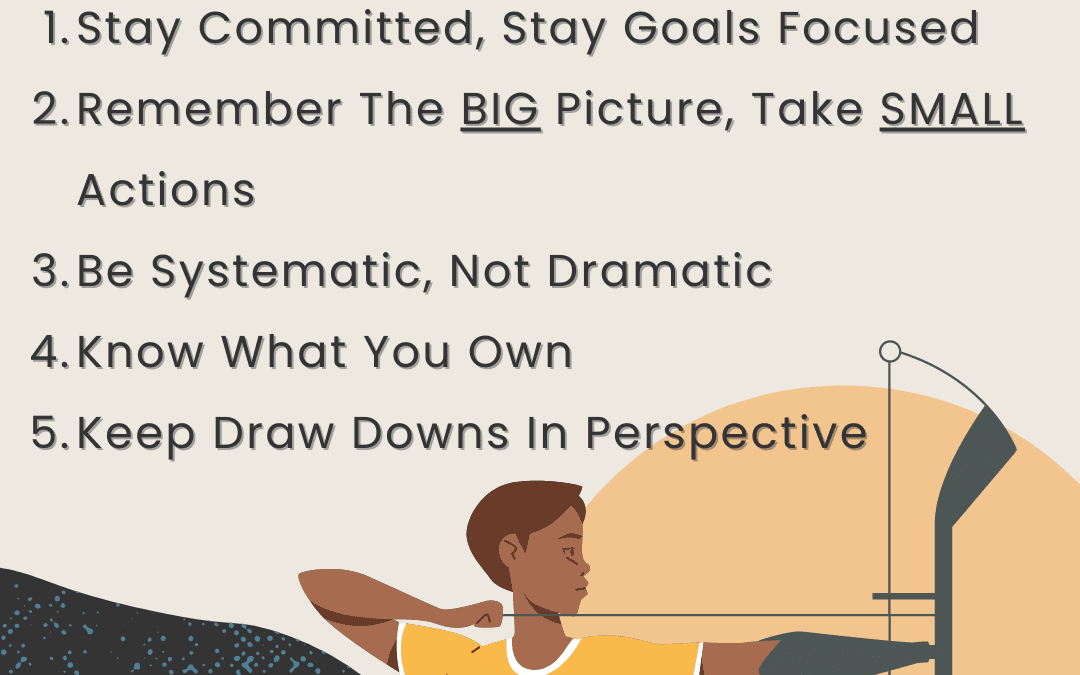

1) Stay Committed, Stay Goals Focused First and foremost, resist the urge to run. It is natural and normal to think, “I could just sell everything and reinvest when the markets start to trend up again.” Please don’t do this. Millionaires...